LendingClub — The Fast Growth FinTech You Didn’t See Coming

LendingClub (LC) has become a boon for borrowers as well as investors and has turned into a viable option in comparison to loans from banks. Let us look at reasons behind its fast growth. In the early days I used to get 20%+ returns annually from trading LendingClub notes. That rate of return has fallen but I still believe in LendingClub.com. I even still have the monthly statements to prove it. Also, LendingClub has extremely powerful network effects.

LendingClub and Its Utility for Borrowers and Investors

LendingClub is operating a unique credit marketplace which allows peer to peer lending as well as investing. Due to machine learning, crowd consensus and other mechanisms, LendingClub typically provides lower rates in comparison to what banks offer. For instance, in a recent interview with Bloomberg, LendingClub CEO Scott Sanborn states that customers save on average 24% interest, when borrowing with LendingClub.

Lower Operating Costs Then Banks

LC is able to provide lower interest rates due to the fact that the bulk of their services are automated and as such they have less overhead. Additionally, the borrowing as well as investing processes takes place online, resulting in faster operations, better efficiency and no brick and mortar locations needed. As such, they have lower operating costs and this savings is passed onto customers in the form of lower rates and investors. This makes perfect sense. The good news is that LendingClub loan originations are up 10% in Q2–17. LC is chewing up the competition over time.

Network Effects

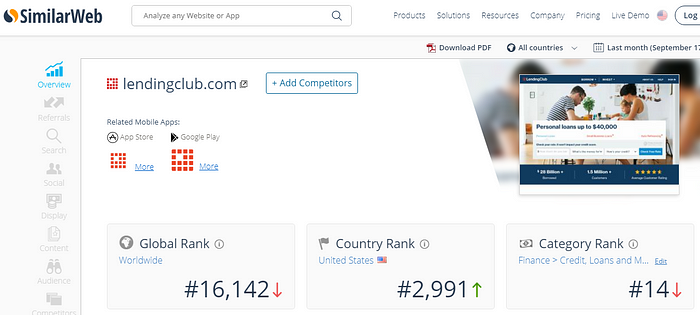

LendingClub.com is the #14 ranked in Finance > Credit, Loans category. This exceeds most banks in existence. They also have a unique mobile app for both Apple App Store and Google Play. These network effects are extremely powerful and should not be underestimated.

Benefits of Taking a Loan from LendingClub

- Fixed monthly payments

- No hidden fees

- Low fixed rates

- Flexible terms

- Simpler online application

- No penalties for prepayment

An Innovative Approach — Peer to Peer Lending

For small businesses, LendingClub has become a life-saver since it allows businesses to get loans of as much as $300,000 for up to a 5-year term and available rates which are quite competitive with bank rates. The main difference between this type of lending and typical bank loans is that in p2p lending the loans small business obtain are backed by a mix of retail and institutional investors.

Such lending has made the company quite popular and is reflected in the fact that it took just 10 years for the company to move from its inception onto its current publicly traded status (LC) and was able to arrange $28+ billion as financing for customers.

Other P2P Lending Companies Tested

I have also sufficiently tested Prosper and BTCJam (no longer in business) and I have to say that my LendingClub returns are the most reliable. I may post my returns on BTCjam or Prosper later. Also, note that GS Marcus has a lending platform but I would argue that educated borrowers and investors will always choose LendingClub over Marcus. LendingClub is like the good guy and in the long term it is uncertain whether Marcus will keep rates low for borrowers. Marcus also does not let retail investors on their platform and I doubt they ever will.

Interested in learning more? Explore our Connecticut SEO Agency and delve into our Bitcoin Blogspot for a wealth of free, original content. Don't miss out—share this post, and thank you for reading!

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. Your investment could go to zero. This is a long term holding.

*Disclosure: I own some LC.

Comments

Post a Comment