Short Hedge Funds Fail To Tank GME

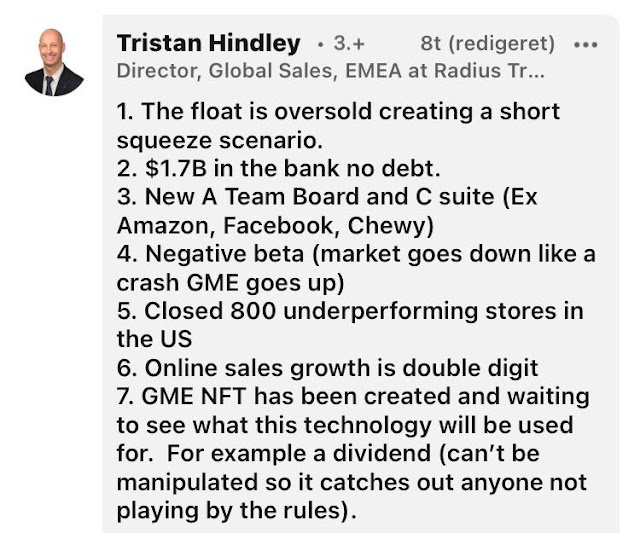

Hedge Funds fail to tank the price of GME after a great quarter. You can see the manipulation of the price after hours to trick investors into selling. No one sold and within 24 hours, the price of GME rebounded to where it was when great earnings came out. You can see in this infographic how GameStop, Q2 2021 compared to Q2 2020. I will not go into detail about this but the graphic pretty much says it all. GME is becoming a tech company and the transformation is happening in real time. A ton of information is surfacing on Reddit and the Internet in general about GME vs the evil competition. Did you know that it is Amazon's fault that Blockbuster, Sears and Toys “R” Us went bankrupt. Yes, Amazon teamed up with some short hedge funds to co-opt the above companies and force them into bankruptcy. Some people are now boycotting Amazon including Whole Foods due to outrage. Funny, now that GME is thriving, Blockbuster, Sears and Toys “R” Us the stocks are pumping 1,500% from the grave. R